Connect Bank Account

To swiftly and accurately assess your customer’s creditworthiness, our innovative solution combines sophisticated financial statement analysis with seamless diverse options to provide a comprehensive view of their overall financial health.

With the use of AI technology, this process not only streamlines credit evaluations but also empowers fast, informed decisions.

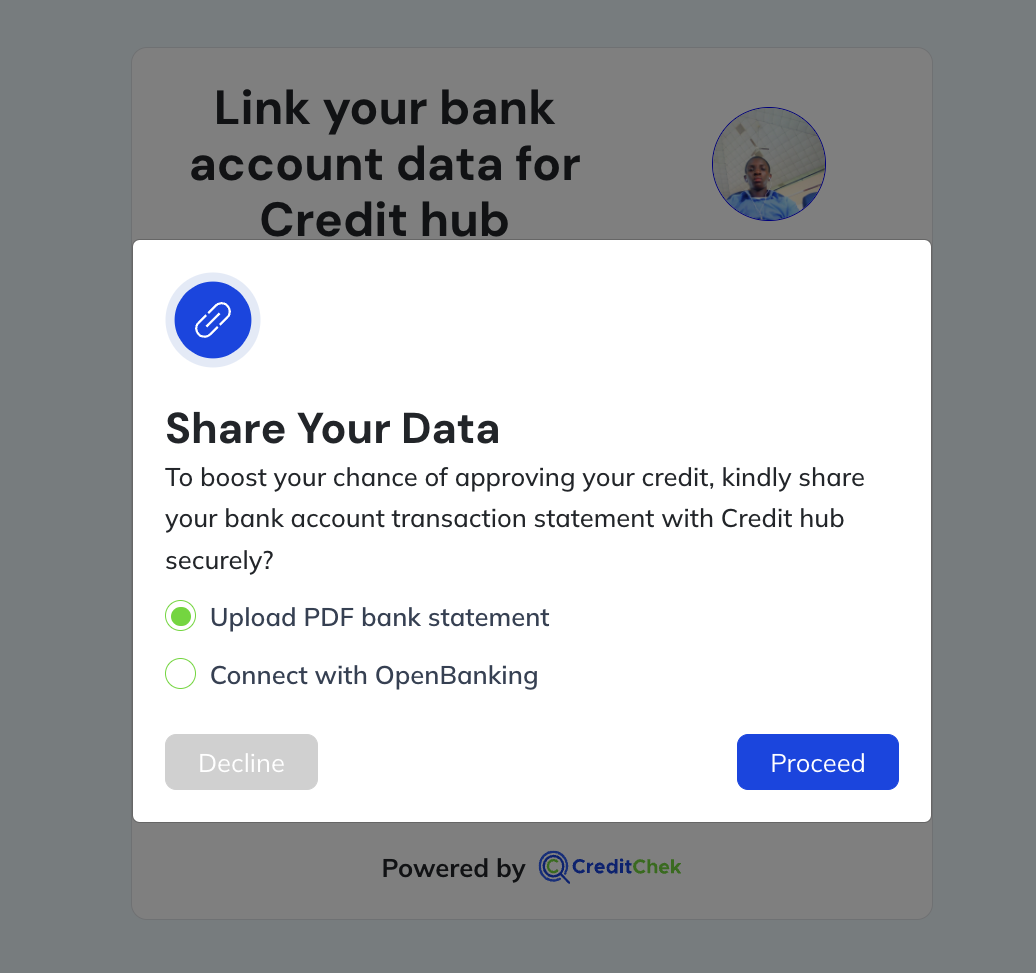

From the image above, we have two (2) options available for connecting your bank account, you could either;

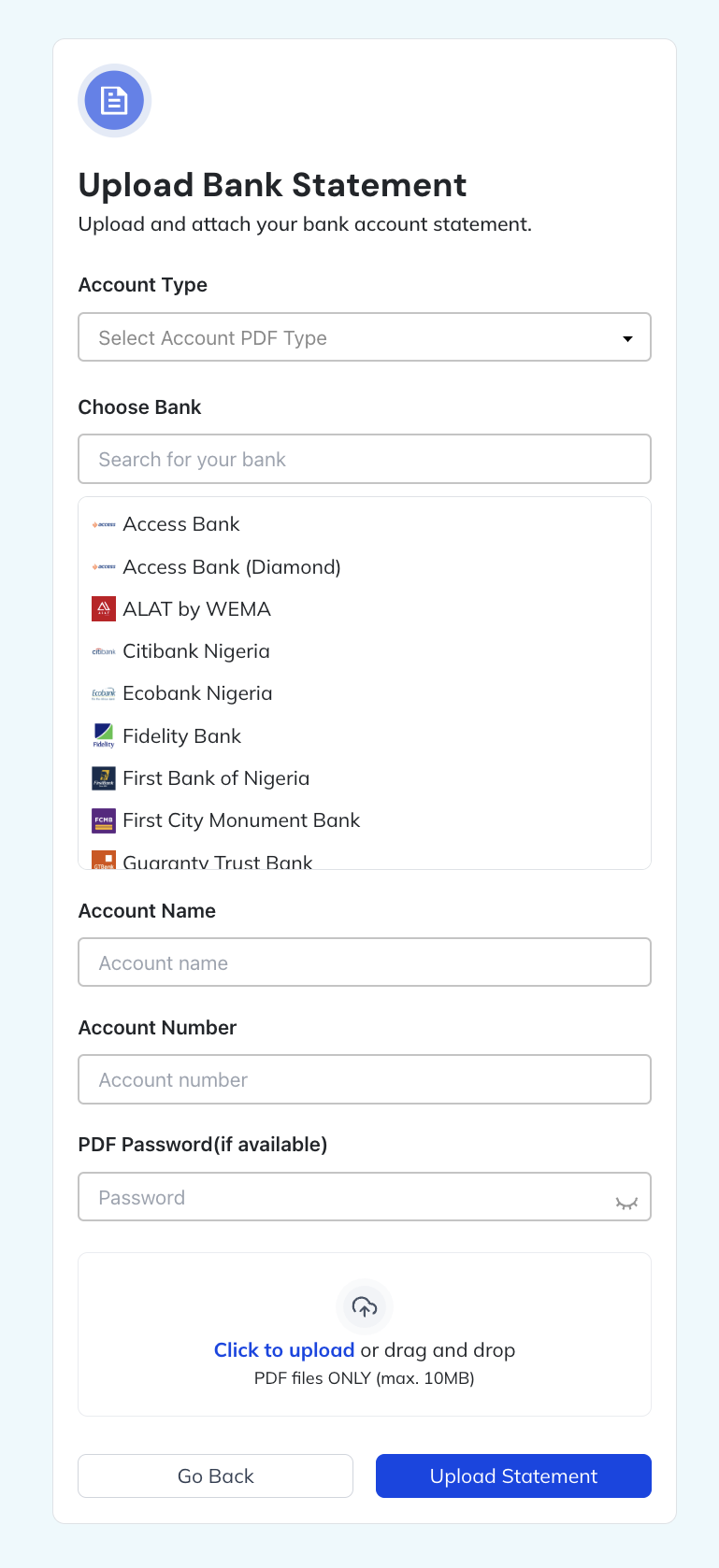

Upload Bank Statements (PDF): Easily upload your bank statements in PDF format directly into our platform. This method is fast, secure, and convenient. Our platform utilizes advanced data extraction, load and transform (Artificial Intelligence) techniques to analyze the raw data from your statements accurately and efficiently, transformed into actionable intelligence for your credit risk decision.

Open Banking Integration: This option allows you to securely & conveniently connect your bank account directly from our platform using your secured authorized time based one time codes (TOTP) issued by your bank as full consent to share your transaction details in line with the OpenBanking Framework guidelines of the CBN.

This secure method allows our system to retrieve your bank statements automatically, eliminating the need for manual uploads. Enhanced efficiency and real-time data access ensure a faster credit evaluation process.

All NUBAN bank statements are currently supported by our system can be analyzed through the platform’s AI-powered PDF statement reader.

We currently don't support all banks via our open banking integration but they would all be available soon.

Some PDF's generated through Mono are also accepted and they include: United Bank for Africa, First City Monument Bank and Guaranty Trust Bank