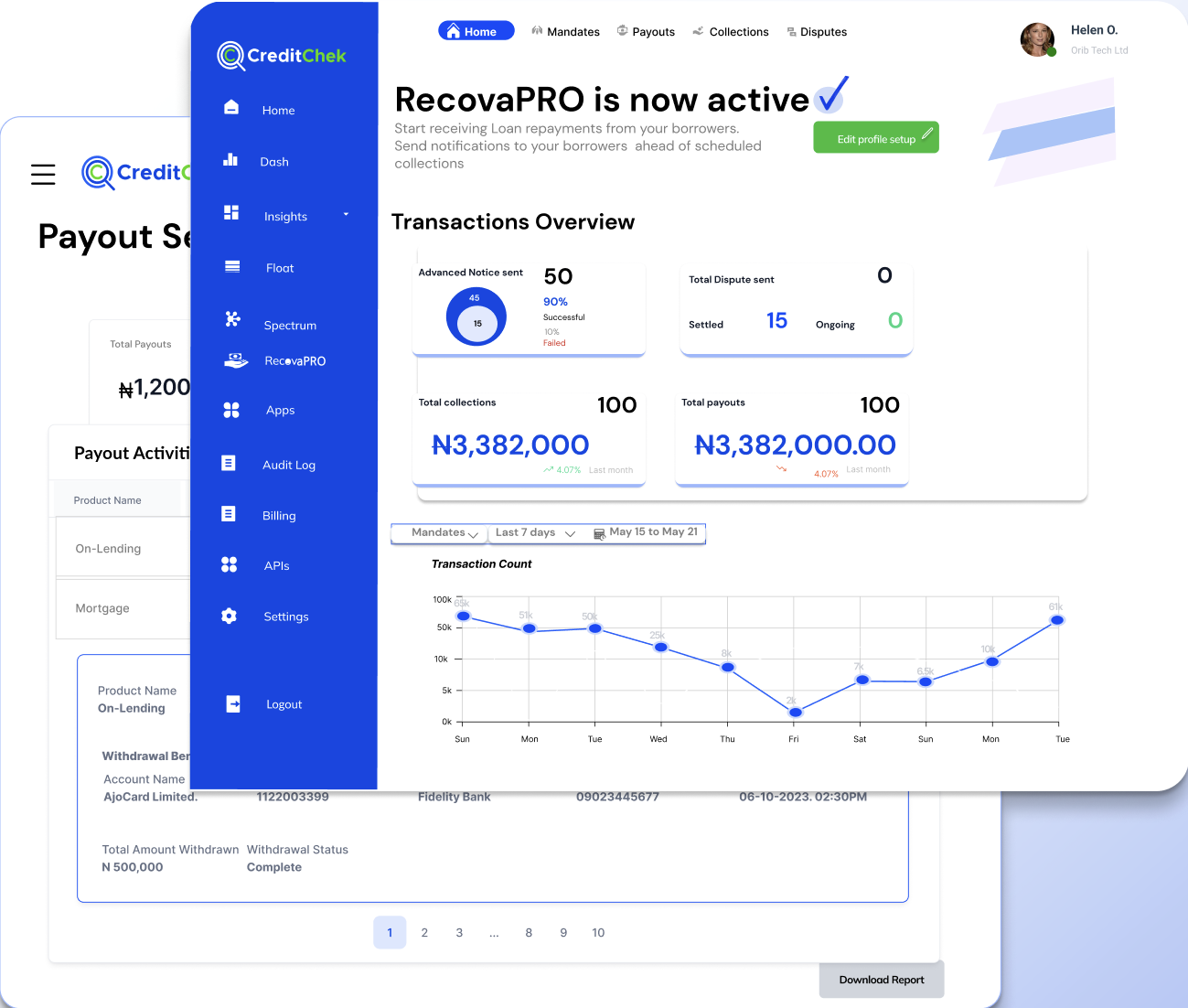

Overview

RecovaPRO is an embedded credit-risk, all-in-one technology solution built for businesses offering diverse lending, embedded finance, or post-paid services; it has an automated direct debit payment capability that allows merchants to collect payments directly from customers’ bank accounts by leveraging the nation’s bank transfer platform built for all forms of electronic payments (Internet banking portals and mobile banking apps), a suite of opt-in embedded credit-risk (insurance) tools that assures no merchant’s business fund is lost to bad debt.

This is a faster, more reliable, and more secure way to recover payments from customers without entering their debit or credit card details. Before you can start using or integrating the RecovaPRO solution as a merchant, please note that you have to complete onboarding, and configure your merchant’s profile with custom settings on the CreditChek SaaS Portal.

As a SaaS platform with the benefit of convenience to delivering timely speed to market, this solution is easily accessed or used via our dedicated Merchant’s Web Portal, as well as other integration channels into existing or new digital products.

The following features are available in CreditChek’s RecovaPRO solution;

One-time payments

One-time debit empowers your business to secure full consent for executing a singular debit transaction from your customer's bank account. This option is ideal for scenarios where customers seek to make a single post-paid payment without engaging in any recurring commitments or intricate arrangements. For API or SDK integrations, upon the completion of a successful asynchronous payment transaction, a webhook is activated to verify the transaction status, enabling your platform to effortlessly receive real-time automated updates.

The minimum single direct debit value accepted and processed is N250.00

Recurring payments

The Recurring debit payments feature caters to businesses with post-paid service models. Merchants can set up recurring payments of “fixed” or “variable” value in terms of amount, allowing customers to purchase your products or subscribe to your services easily. Also, managing subscription renewals and pay later (post-paid) services becomes seamless; and provides a hassle-free payment structure and debt recovery experience for your customers.

A suite of embedded Credit-Risk Management tools

This suite of embedded credit risk management options guarantees that businesses with diverse post-paid service models never lose revenue, capital, or products to bad debts. As a merchant, while configuring your profile, you can opt-in for this value add-on service in your RecovaPRO custom profile, allowing your customers to purchase your product or subscribe to your services without fear of any potential business loss; and provide a hassle-free debt recovery experience for your customers. See more details about our ERM Add-on here.

Opt-in automated Credit Reporting (to partner credit bureau)

A reliable value add-on, opt-in service to automate how diverse lenders or merchants can safely and conveniently automate reporting customers' lending(credit) and repayment behavior (activities) to our partner credit bureau in the same integration, from the same platform (a true all-in-one technology platform as a reliable lender’s choice 😉); without any hassle.

Payouts

All business (merchants) requires a dependable method for ensuring the receipt of all recuperated merchant funds to sustain ongoing expansion reliably. Thus, it is easier to provide more credits, recover, “rinse, and repeat” without hassle when onward settlement is reliable and available during operational hours. Our platform allows merchants to request electronic payouts every Monday through Saturday (9 am to 6 pm). It guarantees to get funds in the setup or desired destination bank account (taxes and surcharges excluded) within an SLA(service level agreement) of two hours.

Dispute Management

The solution is designed to protect our diverse lenders and merchants in many undesirable business situations, thus the need to provide a dependable electronic communication channel to safely & transparently dispute cases such as wrong repayment, failed schedule, or recover any repayments from active/expired mandates with verifiable credit risk claims(event of force majeure, uncontrollable loss, and delinquencies) stemming from such non-performing debt.

Product Management

The solution is designed to aid merchants in automatically associating each e-Mandate to a specific product and optionally their preferred collection (settlement) bank account (add-on coming soon).