Overview

The Secured SDK Engine is a lightweight product that gives businesses access to a pool of CreditChek API services and a decision engine.

The Secured SDK Engine uses the same technology as our main application to allow your customers to carry out assessments. The customer assessments help you determine the decisions to make when they apply to your product. With our Secured SDK, you are able to customize the functionalities according to how you see fit for your business. The assessments carried out on this secured SDK includes:

- Identity verification

- Credit Bereau History search

- Income Assessments

- Automated immediate credit decision outcome

Sign up on the B2B app

Please Sign Up to get started here - https://app.creditchek.africa/auth/signup

The first thing you need to do is to go to the B2B portal at https://app.creditchek.africa/auth/signup to create an account with CreditChek. After signing up, follow the process required to verify your account on the app using the verification code sent to you email used for account creation. After this is done, you can then login.

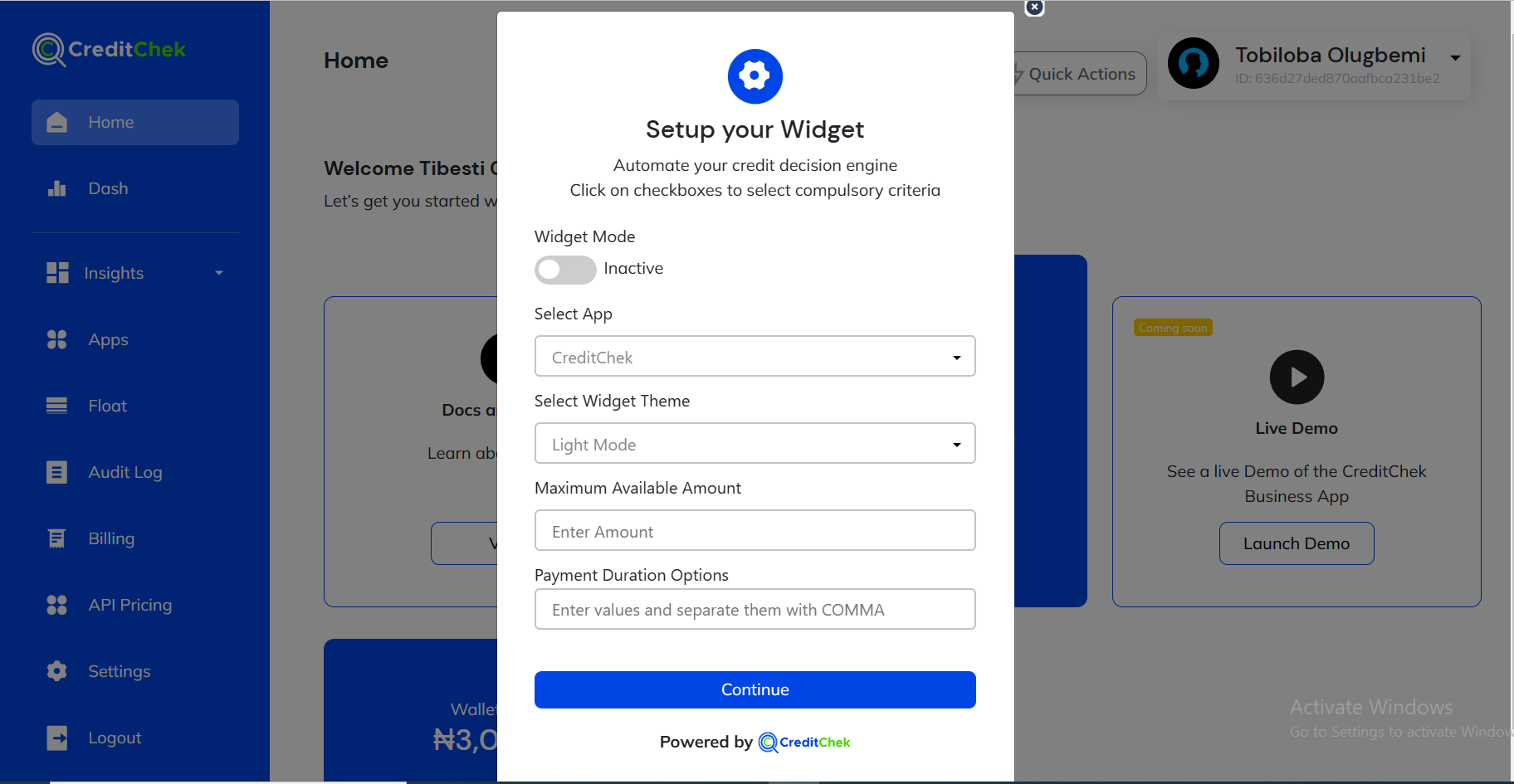

Set up your widget

To setup your widget, you go to the home page and click on the button that says “Setup Widget”. A modal will pop up looking like the one below, then you can then input all your preferences and save them.

SetUp Parameters

| Field Name | Required | Description |

|---|---|---|

| Widget Mode | True | Allows you to set your widget either to an active or inactive state |

| Select App | True | Allows you select an app that your widget operations becomes tied to, default is CreditChek app |

| Select Widget Theme | True | Allows you to choose whether the widget should be in light mode or dark mode |

| Maximum Available Amount | True | This allows you to set a maximum value of money that should be requested for by the customer |

| Payment Duration Options | True | Allows you to set different payment duration options for your customer |

| Minimum average monthly income | True | Allows you to set a minimum value for borrower’s average monthly income |

| Minimum monthly sitting balance | True | Allows you to set a minimum value for borrower’s average monthly account balance at the end of every month |

| Choose preferred credit history source | True | This allows you to select preferred credit bureau(s) that you want your borrower's data to be gotten from (you can select more that one) |

| Maximum outstanding loan value | True | Allows you to set a maximum acceptable limit on the borrower’s overall outstanding loan value |

| Total active loans | True | Allows you to set a number that sould not be exceeded as the borrower's total number of active (open) loans |

| Existing credit overdue | True | Allows you to know if a borrower has defaulted on any active (open) loan from his repayment history |